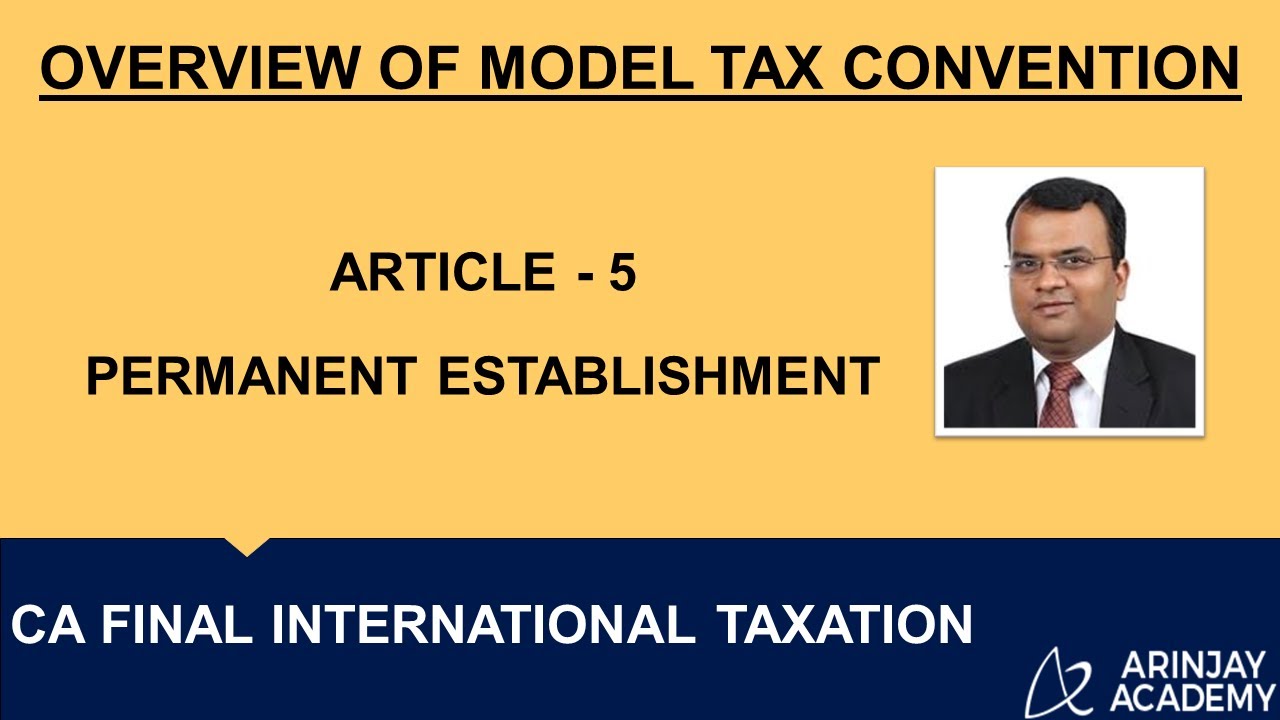

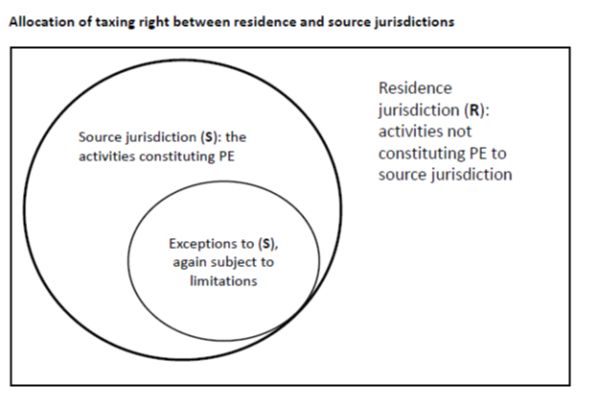

Lexefiscal - Permanent Establishment or Not? When it comes to tax, trading internationally from a fixed place of business is quite confusing and daunting. If you are trading abroad, the location where

Amazon.com: Evaluating Tax Expenditures: Tools and Techniques for Assessing Outcomes: New Directions for Evaluation, Number 79 (J-B PE Single Issue (Program) Evaluation): 9780787915520: Datta, Lois-Ellin, Grasso, Patrick G.: Books

An Examination Of The BEPS Action On Artificial Avoidance Of Permanent Establishment Status (Part 1) - Tax Authorities - China